Among the Advanced Therapy Medicinal Products (ATMPs), in the immunotherapy market, nowadays two acronyms catch the eye: CAR-T and TCR-T. The two techniques are based on the insertion of a specific receptor on the T-cells to enable them to detect and kill the tumor cells specifically. When the receptor is the result of the combinations or part of receptors coming from lymphocytes B and T, we speak about a CAR, Chimeric Antigen Receptor. On the other hand, when the receptor is a T receptor specific for a certain antigen, we speak about TCR, T cell receptor. Both technologies belong to the gene and cell therapy field. CAR-T is historically a well-established technique, FDA approved, with some products already available on the market. In the last decade, the TCR-T technology emerged. Despite a shared process backbone, the two technologies present several immunological, molecular, and therapeutic differences. This post will provide enlightenment on the different aspects of these two techniques and the market expectations and predictions.

General

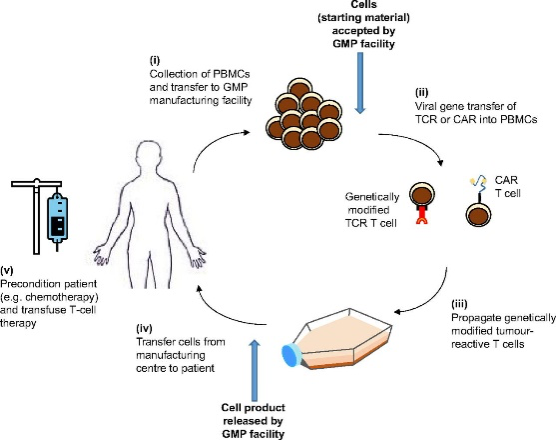

Both CAR-T and TCR techniques are based on a similar manufacturing process (Figure 1). Briefly, the apheresis material of the patient is collected in the hospital and sent to the manufacturing site. CD8+ T-cells are isolated, activated (only in case of TCR), transduced via a viral vector with the gene of interest, expanded and reinfused in the patient (Figure 1). The transduced CD8+ T cells, expressing a specific receptor (gene of interest) allow the recognition of tumor-specific surface markers to initiate an immune response against tumor cells.

If you want to have a deeper overview of ATMP, click here to visit our dedicated blog post.

Differences between CAR-T and TCR-T:

When looking at the manufacturing process you may wonder why both techniques exist side by side and are continuing to be explored for commercialization? The secret lies in the application and the proven efficacy thereof. CAR-T is FDA approved and highly effective against blood tumors, TCR are currently in clinical trials and show a greater efficacy against solid tumors compared to CAR-T.

Table 1 gives an overview of the most prominent differences between CAR-T and TCR-T techniques. The differences displayed makes the two techniques complementary, and it is directing the TCR development toward the solid tumors.

Table 1: Summarizing differences between CAR-T and TCR therapies.

| CAR T | TCR | |

| Recognition | Surface-antigen based | MHC on the antigen presenting cells |

| Receptor | Chimera which combines the recognition and activation parts in one surface receptor | Native although specific for an antigen |

| Specificity | Low | High |

| FDA status | Approved therapy for multiple forms of cancer | Still under the phase of clinical trial, pending approval |

| Activity | Blood tumors hematological malignancies | Solid tumors |

The beginning of research to CAR-T therapies taught us that we can instruct and empower the ability of our immune system to fight tumors, leading in a later stage to the development of TCR-T. Out of 84 TCR clinical trials in 2018, 84% were targeting solid tumors, possibly because CAR-T has already a well-proven efficiency in treating hematological malignancies, whereas it was proven unsuccessful on solid tumors.

Commercialization of T-cell therapies gaining momentum

Following the successful clinical trials for both CAR-T and TCR-T and the FDA/EMA approval of multiple CAR-T therapies, the T cell marketing is booming all around the world. Many healthcare companies historically not working with T cell technologies, are now acquiring the knowledge and equipment, by opening new centers and acquiring necessary government approvals, focusing on partnerships, acquisitions, and merges. The use of partnership, acquisition and merges are done either to catch up with competitors already possessing the necessary infrastructures and know-how, or simply to expand the production capability and treatment portfolio. Among recent European examples there are Lonza that bought Pharmacell in the Netherlands in 2017, Bayer which purchased US Bluerock Therapeutics for 1 billion USD in 2019 and more recently Catalent that purchased Masthercell in Belgium this year (2020).

Current US projections forecast a T-cell market growth from 2.38 billion USD in 2018 reaching 8.37 Billion USD in 2027, with an annual growth rate close to 15%. Whereas the global cancer gene therapy market expects an annual growth rate of 32.5%. Even though US and UK are home to the most prominent players in this market, the Asia Pacific area is rapidly advancing its healthcare industry. Combine this with increasing numbers of cancer patients in China and India, and you can understand that there will be a push towards a significant market share in that area.

Looking at the end users, clinics and ambulatory centers are expected to grow at a rate close to the market (13%). Likewise, hospitals are expected to grow with a pace of 15% annually, reaching a market share of 50% by 2027, thanks to a higher patient count and investment in R&D in oncology.

Challenges to commercialization:

The challenges in this field are multiple from several perspective. A recent survey among 243 companies involved in the ATMP field in Europe, identified major issues. The main challenges highlighted by the survey were regulatory, manufacturing, and scientific challenges. The regulatory challenges are mainly coming from the process. It often involves GMOs, and stringent control steps are required at several stages to comply with GMP regulations. The technical challenges are related to the manufacturing and its requirements in terms of space and difficulties in application of quality assurance. The scientific challenges are mainly centered around the difficulties encountered during trial design. Furthermore, from a development point of view, finding new antigens is an issue in terms of cost and manufacturing. Another major challenge are the different levels of development and manufacturing. A solid part of the R&D activity is performed at university level or carried out in spin-off, within the academic environment. The direct consequence is that there is a lack of regulation at this level and lack of infrastructure for the production. When the product is ready for manufacturing a CMO is contacted for the production in large scale. These products very often pose a translational challenge during the technology transfer phase. They are developed in a limited regulatory environment and manufactured within the stringent GMP regulation. This mismatch may lead to a stop of the tech transfer and a step back to the product development phase, with increase of time and cost. (If you want to know more about the ATMP commercialization, please visit our blog on the main hurdles to be talked for the marketing of ATMPs.

A solution might be a risk- based approach that identifies in advance the critical point and enables to tackle them during the developmental stage. The tech transfer will start with a solid process already designed to be scalable and with high degree of automation. Our software platform CbD combines the aforementioned points to help in the ATMPs development and commercialization. Our final goal is to decrease the R&D to manufacturing time, allowing this promising technology to reach the market with affordable prices.

If you want to know more about the tech transfer, please visit our dedicated blogpost.

References:

“The Emerging World of TCR-T Cell Trials Against Cancer: A Systematic Review” – Technology in Cancer Research & Treatment – 2019

“T-Cell Therapy Market To Reach USD 8.37 Billion By 2027” – Reports and Data 2019

“CAR-T Cell Therapy Market Size – Detailed Analysis of Current Industry Figures with Forecasts Growth By 2026” – 2020

(Image) gene_therapy_cellular_therapy_gsk_miltenyi_biotec_manufacturing_gmp_cancer_leukemia

“Difference Between CAR-T and TCR-T” – www.differencebetween.com

“Lonza plugs EU cell and gene therapy manufacturing gap through PharmaCell buy” – w ww.biopharma-reporter.com – 2017

“Bayer buys BlueRock in $600 million bet on stem cell therapies” – www.reuters.com – 2019

“Catalent Completes Acquisition of MaSTherCell” – www.catalent.com/catalent-news – 2020